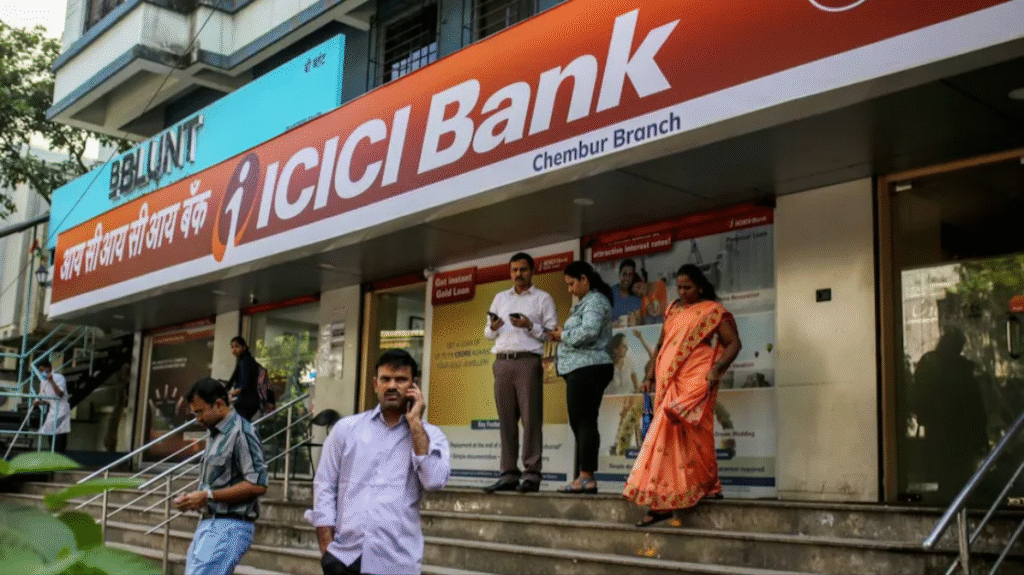

ICICI Bank has triggered strong reactions online after slashing financial inclusion, with a sweeping increase in savings account requirements, effective August 1, 2025. The changes prompted criticism over equity and consumer rights.

ICICI Bank Minimum Balance: What Has Changed?

- For new accounts opened post-August 1:

- Metro/Urban: MAB has soared from ₹10,000 to ₹50,000 (a 5× hike).

- Semi-Urban: Increased from ₹5,000 to ₹25,000.

- Rural: Requirements rose from ₹2,500 to ₹10,000.

- Existing account holders are unaffected and remain under earlier MAB norms.

- Penalty for non-compliance:

- 6% of shortfall or ₹500—whichever is lower.

The bank has also updated cash transaction rules, ATM fees, and service charges.

Public and Legal Repercussions

Public Backlash

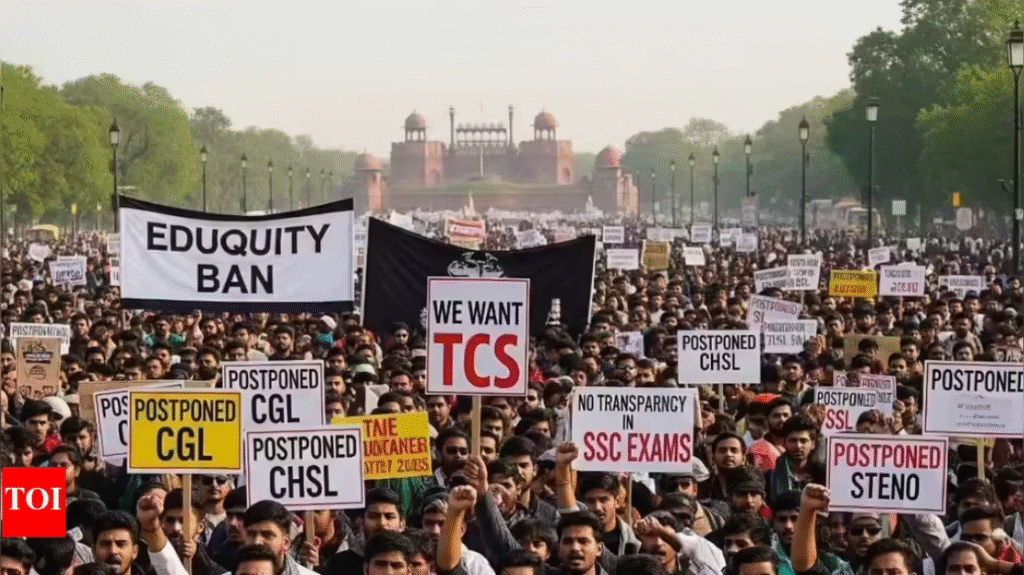

Many users labeled the change “elitist” and “exclusionary,” pointing out that a sizeable portion of India earns less than ₹27,000 monthly. Social media erupted with calls for RBI intervention.

Contrasting Bank Practices

While ICICI enforced stricter norms, numerous public sector banks (PSBs) are either waiving or reducing MAB penalties. Critics see ICICI’s move as prioritizing affluent customers and revenue generation over inclusivity.

Legal and Regulatory Focus

Right to Financial Inclusion

Indian law grants citizens right to banking services. By elevating MAB fivefold, ICICI could be limiting access for economically weaker groups. Legal experts say this raises questions under Article 14 of the Indian Constitution (right to equality).

RBI Oversight

Banks are regulated to ensure they serve public interest. An extraordinary hike like this may warrant the RBI to assess whether it violates fair access guidelines or merits policy scrutiny.

Contractual Accountability

Legally, ICICI should have clearly communicated revised terms to new customers. Any vague protocol could lead to disputes. Further, blanket penalties—even if capped—must be enforceable without bias.

What You Should Know

| Category | Details |

|---|---|

| Urban Customers | MAB increased from ₹10k to ₹50k |

| Rural Customers | MAB raised to ₹10k from ₹2.5k |

| Penalty Structure | 6% of shortfall or ₹500 (lower amount) |

| Existing Accounts | Not affected; retain old MAB norms |

| Legal Concerns | Possible violation of rights and inclusion norms |

| Regulatory Outlook | Might prompt RBI evaluation on banking access |

Bottom Line

ICICI Bank’s steep MAB hike clearly repositions its savings accounts toward higher-end customers. While legitimate as a private bank, it raises equity concerns, especially when many PSBs are lowering thresholds to expand access.

Key legal angles to observe include RBI’s regulatory review, consumer protection litigation, and potential advocacy under equality and inclusion mandates. This episode underscores the delicate balance between profitability and accessibility in modern banking.

To read more Indian Laws and news, visit Legal Guide India